us capital gains tax news

Capital gains tax take hits 10bn use these tricks to pay less. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

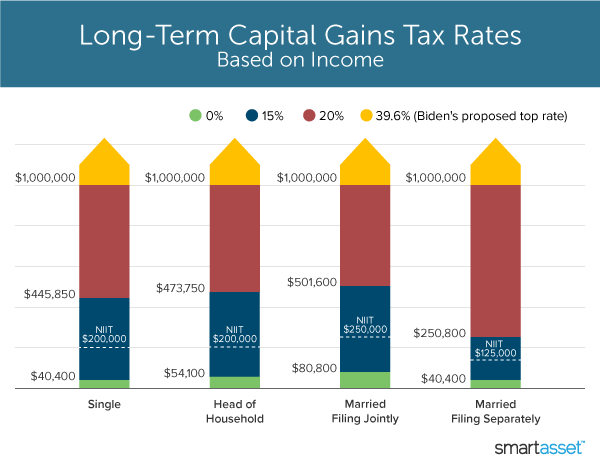

Youll owe either 0 15 or 20.

. -Single filerswith asstes sold over. -Single filers with asstes sold at 41675 - 0 Tax Rate. Learn about long- and short-term capital gains tax on stocks the tax rate and how you can minimize taxes on capital gains.

Record amount paid by investors which is likely to increase in the coming years. To calculate the gain you use the amount you originally paid for the property and deduct that from what you got for the property. The gains are taxed at a maximum of 28.

Capital Gains Tax News. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. A capital gain rate of 15 applies if your taxable income is.

September 15 2021 455 PM MoneyWatch. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er. Advisors Eye Capital Gains Tax Changes.

Which since all of that would fall within the 0 percent. The top federal tax rate on capital gains could reach levels not seen since the 1970s under the House Democrats proposed 35 trillion budget. Last years tax gains.

Investors should understand the various factors that can help them mitigate and potentially defer paying capital gains tax from selling real estate properties. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household.

Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. A decision made last year to freeze the Capital Gains Tax CGT allowance until April 2026 has earned the treasury billions of pounds in. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

In the United States of America individuals and corporations pay US. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20.

On day 101 of 105 in Washingtons legislative session the House of Representatives approved a new capital gains tax in a tight 52-46 vote. By Associated Press July 13 2022. The tax rate on most net capital gain is no higher than 15 for most individuals.

The Washington Supreme Court has agreed to review a decision by a lower court that overturned a new capital gains tax on high profit stocks bonds and other assets. Long-Term Capital Gains Taxes. So in your case the gain is 88000 that is 140000 minus.

Rental property owners will benefit. Capital Gain Tax Rates. -Single filerswith asstes sold at 41675 to 459750 - 15.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Passed by the Senate in March in another narrow vote.

The proposal may affect a relatively small number of investors but planning now is wise. After the capital gains exclusion you would owe taxes on the remaining 30000. The bottom 99 on.

Relevance is automatically assessed so occasionally headlines not about Capital Gains Tax news.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Calculating Taxable Gains On Share Trading In New Zealand

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Daily U S Session Watchlist Eur Jpy Capital Gains Tax Capital Gain Chart

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Tax What Is It When Do You Pay It

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How Is Cryptocurrency Taxed Forbes Advisor

This Tax Brings In Billions Worldwide Why There S No Vat In The U S

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)